2025 Rebate Checks: What You Need to Know to Claim Your Share

As we approach 2025, many consumers are looking forward to the potential for rebate checks from the government. These checks are aimed at providing financial relief to taxpayers amidst rising living costs and inflation rates. For those wondering how to navigate the process of claiming their rebate checks, this article will break down the essential information you need to know.

What Are Rebate Checks?

Rebate checks are direct payments made by the government to eligible taxpayers. They serve as a form of financial assistance, often designed to boost consumer spending and stimulate the economy. These checks can be issued for various reasons, such as tax breaks, stimulus measures, or offsets for rising prices on essentials like food and gas.

Who Is Eligible for the 2025 Rebate Checks?

Eligibility for rebate checks varies by state and the specific programs enacted by government authorities. Generally, most states will require that you meet specific income thresholds and have filed your taxes for the previous year. Here are some common criteria you might need to fulfill:

- Filing Status: You must be a resident and have filed your tax returns.

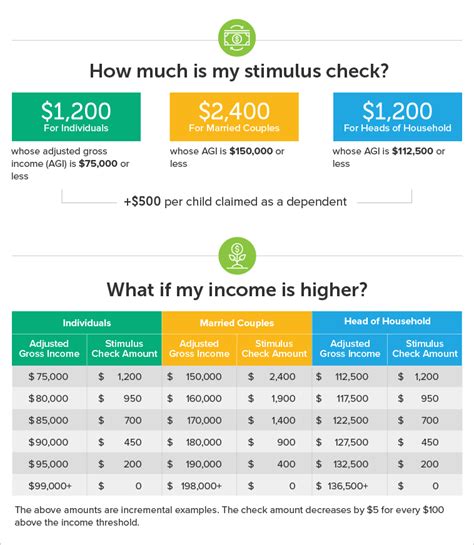

- Income Requirements: Most states will establish income limits. Individuals or families exceeding these income brackets may be disqualified.

- Dependents: Some programs may offer additional benefits for taxpayers with dependents.

How to Claim Your Rebate Check

Claiming your rebate check requires a few straightforward steps:

- File Your Taxes: Make sure your tax returns are filed accurately and on time. This is your primary step to qualify for the rebate.

- Check for State-Specific Applications: Some states might require a separate application for the rebate, even after filing your taxes. Always check the state treasury or revenue department’s website.

- Provide Necessary Documentation: Ensure that you have all required documentation ready, including proof of income and identification.\

- Monitor Payment Methods: Payments may be issued via direct deposit or check, depending on your preferences stipulated during tax filing.

When Will the Rebate Checks Be Issued?

The timing of rebate checks can be elusive, but generally, you can expect them to be issued shortly after the tax filing deadline. For the 2025 rebate checks, the expected timeline is likely to fall between late spring and early summer, provided the budget is approved and implemented on time.

Potential Benefits of Rebate Checks

Rebate checks can have significant impacts on individual households, as well as the broader economy. Here are a few benefits:

- Boost in Disposable Income: This money can help families manage monthly expenses, providing needed financial relief.

- Stimulating the Local Economy: Increased consumer spending can help local businesses, thereby fostering economic growth in the community.

- Reducing Poverty Levels: These checks can play a critical role in alleviating financial stress for low-income families.

Challenges and Considerations

While rebate checks are generally considered beneficial, there are challenges to keep in mind:

- Eligibility Fluctuations: With changing tax laws, it’s essential to stay updated on eligibility requirements which could vary year by year.

- Delay in Payment: Some recipients may experience delays in receiving their checks, causing temporary financial strain.

- Potential for Misunderstanding: Miscommunication on eligibility could lead some people to think they are receiving checks when they are not.

What to Do If You Don’t Receive Your Check

If you were expecting a rebate check but haven’t received it, there are steps you can take:

- Check Your Tax Filing Status: Ensure that your taxes were filed correctly and on time.

- Verify Eligibility: Reassess your eligibility criteria to see if any factors have changed since applying.

- Contact the State Revenue Department: If you believe you should have received a check, reaching out to the appropriate government agency can provide clarity.

Conclusion

The potential for rebate checks in 2025 presents a beneficial opportunity for many households across the country. By understanding the eligibility criteria, the claiming process, and the associated benefits and challenges, you can better prepare yourself to take advantage of these financial relief measures. As legislation continues to evolve, staying informed will be key to ensuring you receive your fair share of these funds.

FAQs

1. Will all states be offering rebate checks in 2025?

No, not all states will offer rebate checks. Each state has its program, and it’s essential to check your state’s treasury or revenue department for specific details.

2. Do I have to pay taxes on the rebate check?

Typically, rebate checks are not considered taxable income, but it’s a good idea to consult with a tax professional for personalized advice.

3. When can I expect to receive my rebate check?

The expected timeline for receiving rebate checks is typically between late spring and early summer after filing your taxes, assuming all goes smoothly in the budgetary process.

4. Can I claim the rebate check if I haven’t filed my taxes?

No, tax filing is often a requirement to claim rebate checks. Ensure that your tax returns are filed accurately and on time to be eligible.

5. Where can I find more information on claiming my rebate check?

For detailed information, visit your state’s treasury or revenue department website. These resources provide the most accurate and up-to-date information related to rebate checks.

Download Rebate Check That Is For Everybody 2025