Shining a Light on Savings: Understanding Tax Rebates for Solar Panel Installation

As the world increasingly shifts towards renewable energy, solar power has emerged as one of the most favorable options for both homeowners and businesses seeking to reduce their carbon footprint. Not only do solar panels provide a sustainable energy source, they also present an opportunity for financial savings through various tax rebates. Understanding these tax incentives is crucial for anyone considering a solar installation. This article will dissect the different types of tax rebates available, how they work, and how to maximize your savings on solar panel installation.

1. The Basics of Solar Tax Rebates

A tax rebate can be defined as a government incentive that allows property owners to recover a portion of the costs associated with installing solar panels. These rebates can substantially reduce the upfront cost of solar installation, making it more affordable for the average homeowner. In the United States, federal, state, and local tax incentives can all contribute to potential savings.

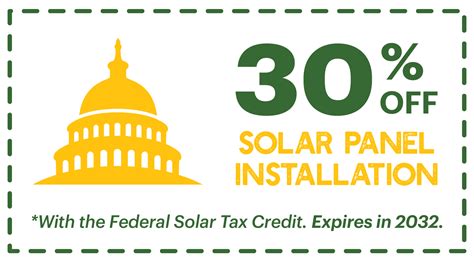

2. Federal Solar Investment Tax Credit (ITC)

One of the most significant incentives available is the Federal Solar Investment Tax Credit (ITC). This program allows homeowners to deduct a certain percentage of the cost of their solar systems from their federal taxes. Currently, the ITC offers a 30% tax credit for systems installed before the end of 2032. After that, the credit will gradually decrease, so acting sooner allows consumers to benefit from the maximum savings available.

For example, if your solar installation costs $20,000, you can potentially receive a tax credit of $6,000 (30% of $20,000) on your federal tax return. It’s important to note that the ITC applies to both residential and commercial systems, and it can also be carried over to subsequent tax years if you do not owe enough in taxes to claim the full amount in one year.

3. State-Level Incentives

In addition to the federal ITC, many states offer their own incentives to encourage solar adoption. These can include cash rebates, grants, tax exemptions, and sales tax exemptions. Each state has its own specific programs with varying terms and conditions.

For example, California has established specific rebate programs for residential solar installations. Meanwhile, states like New York offer a combination of solar tax credits and performance-based incentives (PBIs) that reward solar system owners based on the amount of electricity generated. It is crucial to check with your state’s energy department or local utility provider to fully understand the incentives available in your area.

4. Local Rebates and Incentives

Local incentives can also play a significant role in reducing solar panel installation costs. Some municipalities and utility companies offer rebates and incentive programs to promote renewable energy usage within their communities. These local programs can sometimes provide immediate cash back or discounts that help defray the installation costs.

Additionally, certain local programs may offer net metering, which allows homeowners with solar panels to sell excess electricity back to the grid. This can lead to significant savings over time as utility bills are reduced or eliminated entirely.

5. How to Claim Your Tax Rebates

Claiming solar tax rebates may seem daunting, but the process can be straightforward if you follow a few key steps:

- Document Your Expenses: Keep all receipts and documentation related to your solar panel installation, including contracts, payments, and inspection reports.

- Complete IRS Form 5695: When filing your federal taxes, you will need to complete IRS Form 5695 to claim the Solar Investment Tax Credit.

- Consult with a Tax Professional: Since tax laws can be complex, it may be beneficial to consult with a tax advisor to ensure you maximize your deductions and comply with all requirements.

- Check State and Local Requirements: Research specific forms and applications related to state and local rebate programs to ensure all necessary submissions are completed.

6. Potential Barriers to Claiming Tax Rebates

Despite the many benefits of tax rebates, homeowners may encounter barriers that could hinder their ability to benefit from these programs:

- Eligibility Requirements: Not all systems or installations qualify for tax rebates. Ensure that your installation meets all necessary standards and regulations.

- Filing Errors: Mistakes or omissions during the filing process can jeopardize your eligibility for tax rebates. Double-check all documentation and consider enlisting professional help.

- Funding Issues: Some state or local rebate programs may have limited funding, leading to a first-come, first-served situation. Act quickly to take advantage of these opportunities.

Conclusion

Investing in solar panels is not only a way to reduce your carbon footprint but also a substantial opportunity for financial savings through various tax rebates. By understanding the federal, state, and local incentives available, homeowners can make informed decisions and maximize their return on investment. As energy costs continue to rise and the importance of sustainable practices becomes increasingly evident, now is the perfect time to shine a light on solar savings.

FAQs

1. Can I claim the federal solar tax credit if I finance my solar system?

Yes, you can still claim the ITC if you finance your solar installation through loans or leases. The tax credit is based on the total cost of the solar system, regardless of how it is financed.

2. What happens if the state or local rebate programs change?

Rebate programs can change or be phased out. It’s crucial to stay up to date with local regulations and programs to ensure you take advantage of available incentives before any changes.

3. Do solar tax credits expire?

Yes, the federal solar ITC is set to decrease over time. After 2032, there may be no tax credit available unless new legislation is passed. It’s wise to act sooner to maximize the benefits.

4. How do I know if my state offers solar incentives?

You can check with your state’s energy office or the Database of State Incentives for Renewables & Efficiency (DSIRE) website to find out what incentives are available in your area.

5. Is there a limit on how much refund I can receive from tax rebates?

The amount of tax credit you can claim is generally capped by the total investment cost of your solar system. However, there are no income limits or restrictions on the amount of credit you can claim, allowing for substantial savings for homeowners.

Download Tax Rebate For Solar Panels