Montana Tax Rebate 2025: What Residents Need to Know to Maximize Their Return

The State of Montana has introduced several key financial initiatives, including a tax rebate for the 2025 tax year. Understanding these initiatives is crucial for residents to ensure they are maximizing their refunds. This article delves into the details of the 2025 Montana tax rebate, providing insights that will help taxpayers navigate the process effectively.

What is the Montana Tax Rebate?

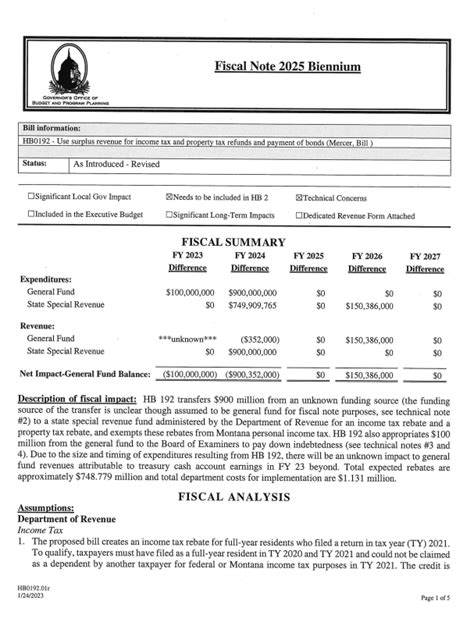

The Montana Tax Rebate is a one-time payment designed to provide financial relief to residents. It is typically offered to individuals and families who file their income taxes. The rebate is aimed at lessening the financial burdens faced by residents, particularly in light of inflation and economic uncertainty.

Key Features of the 2025 Tax Rebate

The 2025 tax rebate in Montana comes with several features relevant to taxpayers:

- Eligibility: Residents must have filed a Montana state income tax return to qualify. Income limits may apply, and these thresholds will depend on the state’s legislative decisions for the 2025 tax year.

- Amount of Rebate: While the exact amount has yet to be finalized, past rebates have typically offered around $1,200 for eligible families. Individual taxpayers may expect slightly reduced amounts.

- Application Process: Residents do not need to fill out a separate application for the rebate as it will be automatically calculated and issued based on their tax filings.

- Timing: The rebates are expected to be issued shortly after the tax filing deadline, which falls on April 15, 2025.

How to Maximize Your Montana Tax Rebate

To ensure you’re getting the most from the Montana tax rebate, here are some strategies and tips:

- File Your Taxes Early: By submitting your tax return as soon as possible, you can ensure you receive your rebate earlier. Being prompt can also help avoid any last-minute issues.

- Understand Deductions: Familiarize yourself with available tax deductions and credits that can lower your taxable income. This, in turn, may increase your eligibility for the rebate.

- Check Eligibility for Other Programs: Assess whether you qualify for other state or federal benefits, such as the Earned Income Tax Credit (EITC), which could affect your overall tax situation.

- Maintain Accurate Documentation: Keep thorough records of your income, expenses, and any relevant transactions throughout the year. Accurate documentation ensures you can substantiate your claims and avoids complications down the line.

Additional Financial Benefits for Montana Residents

In addition to the tax rebate, other financial initiatives may be beneficial for Montana residents:

- Property Tax Rebates: Residents may be eligible for property tax rebates based on their income and property values. It’s important to look into how these programs can complement the tax rebate.

- Education Tax Credits: Program initiatives are available to support education, providing credits for expenses incurred for schooling, which may reduce your overall tax liability.

- Local Grants and Assistance Programs: Various local government programs are in place to assist families and individuals in financial need. Researching these can provide additional support and aid in navigating tougher times.

Conclusion

The upcoming Montana Tax Rebate for 2025 is an important development for many residents seeking financial relief. By understanding the eligibility criteria, following the outlined tips to maximize rebates, and exploring additional financial aid options, taxpayers can navigate this process more effectively. Staying informed and proactive will not only enhance your refund but also provide additional peace of mind during tax season.

FAQs

1. Who is eligible for the Montana tax rebate?

Residents who submit a state income tax return for the 2025 tax year are generally eligible. Specific income limits may apply, so it’s advisable to check the current state guidelines as they can change annually.

2. When will the tax rebate be issued?

The rebates are expected to be issued shortly after the tax filing deadline of April 15, 2025. Early filers may receive their reimbursement sooner.

3. Do I need to apply separately for the tax rebate?

No, the tax rebate is calculated automatically based on your income tax return. There is no separate application process required.

4. How can I maximize my tax rebate?

To maximize your rebate, file your tax return early, understand available deductions, check for eligibility in other assistance programs, and maintain accurate records throughout the year.

5. Are there other financial benefits available to Montana residents?

Yes, there are additional financial benefits, including property tax rebates, education tax credits, and local grants or assistance programs that residents should explore.

Download Montana Tax Rebate 2025