If you are a homeowner in Pennsylvania, you may be missing out on a fantastic opportunity to save money on your property taxes through the Pennsylvania Homeowners Tax Rebate Program. This program offers eligible homeowners a rebate on property taxes paid, which can significantly reduce the financial burden of homeownership. In this comprehensive guide, we will cover everything you need to know to maximize your savings through this program, from eligibility requirements to application processes and important deadlines.

Understanding the Pennsylvania Homeowners Tax Rebate Program

The Pennsylvania Homeowners Tax Rebate Program is designed to provide financial relief to eligible homeowners. The program offers rebates to assist older adults and people with disabilities in offsetting property taxes paid on their homes. It is funded by the state and is administrated by the Pennsylvania Department of Revenue.

Eligibility Requirements

To qualify for the Pennsylvania Homeowners Tax Rebate, you must meet the following criteria:

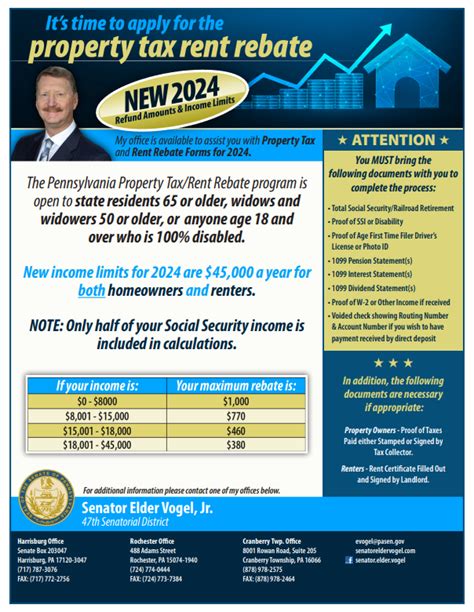

- Age Requirement: You must be 65 years of age or older or be a widow/widower age 50 or older, or a person with a permanent disability regardless of age.

- Income Limits: Your total annual income must not exceed $35,000 if you are a homeowner. This limit is adjusted for special circumstances, such as the additional income thresholds for those who are married and filing jointly.

- Residency: You must be a legal resident of Pennsylvania and must have owned and occupied your home as your primary residence.

How is the Rebate Calculated?

The amount of the rebate you receive is based on your property taxes paid in the previous year and your income level. The formula for calculating the rebate is as follows:

- Homeowners with an income of $0 to $8,000 may receive a rebate of up to $650.

- Homeowners with an income of $8,001 to $15,000 may receive a rebate of up to $500.

- Homeowners with an income of $15,001 to $18,000 may receive a rebate of up to $300.

- Homeowners with an income of $18,001 to $35,000 may receive a rebate of up to $250.

It’s important to note that certain taxes, such as local taxes and other assessments, are not included in the rebate calculation. The rebate is solely based on your property tax bill.

Application Process

Applying for the Pennsylvania Homeowners Tax Rebate is a straightforward process. Follow these steps to ensure your application is complete:

- Obtain Form: Get the application form, known as the PA-1000, from the Pennsylvania Department of Revenue’s website or local tax office.

- Complete the Form: Fill out the necessary information, including your income details and property tax information.

- Submit Supporting Documents: Be sure to attach any required documents, such as copies of your property tax bills and proof of income.

- File Your Application: Send your completed application to the Department of Revenue by mail or submit it online if applicable. Ensure you keep a copy for your records.

Important Deadlines

Keeping track of deadlines is crucial when applying for the Pennsylvania Homeowners Tax Rebate. The application period typically starts on January 1 and runs until June 30 for the tax year. However, Pennsylvania residents aged 65 and older may file for a four-month extension, allowing them to submit their applications until December 31.

Common Mistakes to Avoid

To maximize your chances of receiving the rebate, be mindful of common mistakes:

- Incomplete Applications: Ensure that all sections are completed, and all necessary documents are included.

- Missing Deadlines: Keep track of application deadlines to avoid losing out on your rebate.

- Incorrect Income Reporting: Accurately report all income sources to avoid issues with your application.

Conclusion

The Pennsylvania Homeowners Tax Rebate program is an excellent opportunity for qualifying homeowners to receive financial relief and reduce their tax burdens. By understanding the eligibility requirements, calculating potential rebates, and properly submitting your application, you can maximize your savings effectively. If you think you qualify, don’t delay in applying and taking advantage of this valuable program to improve your financial situation.

FAQs

1. What if I experience a change in income after applying for the rebate?

If your income changes after you have already submitted your application, it is crucial to inform the Pennsylvania Department of Revenue to ensure your rebate reflects your current financial situation.

2. Can I apply for the rebate if I am renting my home?

No, the Pennsylvania Homeowners Tax Rebate program is exclusively for homeowners who pay property taxes on their primary residence.

3. How long does it take to receive my rebate once I apply?

Processing times can vary, but you can typically expect to receive your rebate within 8 to 12 weeks after the Department of Revenue has received your application.

4. Is there a way to check the status of my application?

Yes, you can check the status of your application by contacting the Pennsylvania Department of Revenue or visiting their website for status updates.

5. What should I do if I face difficulties with the application process?

If you encounter any issues, the Pennsylvania Department of Revenue has resources available, including customer service representatives who can assist you with the application process.

This HTML code provides a complete article in WordPress format about maximizing savings through the Pennsylvania Homeowners Tax Rebate, including sections on eligibility, application processes, and FAQs.

Download Pa Homeowners Tax Rebate