Unlocking Savings: A Comprehensive Guide to the PA Rent Rebate Form

Residents of Pennsylvania have access to a valuable financial resource designed to ease the burden of rent expenses: the PA Rent Rebate program. This initiative, administered by the Pennsylvania Department of Revenue, provides financial relief to eligible residents who face high rents relative to their income. This comprehensive guide aims to simplify the process of applying for the PA Rent Rebate Form, helping you unlock potential savings.

What Is the PA Rent Rebate Program?

The PA Rent Rebate program provides rebates to residents who pay rent on their homes and meet certain income requirements. It is a part of the Pennsylvania Property Tax/Rent Rebate Program, originally established in 1971. As of the latest updates, eligible individuals can receive rebates based on their rent payments for the previous year, significantly aiding those in financial distress.

Who Is Eligible?

Eligibility for the PA Rent Rebate program is primarily determined by income and age. Here are the key criteria:

- Age Requirement: Applicants must be at least 65 years old, or be a widow/widower aged 50 or older, or have a permanent disability.

- Income Limit: The annual income limit for applicants is $35,000 for homeowners and $15,000 for renters. These income thresholds include Social Security, pension, wages, and other sources of income but do not include certain types of income, such as inheritances and gifts.

- Residency: You must be a resident of Pennsylvania for the entire claim year.

Jumping into the Application Process

The application process may appear daunting, but breaking it into manageable steps can simplify the task:

1. Gather Necessary Documents

Before you start filling out the PA Rent Rebate Form, collect all necessary documentation. This may include:

- Your income sources and amounts.

- Proof of rent paid, such as lease agreements or receipts.

- A valid form of identification, such as a driver’s license or state ID.

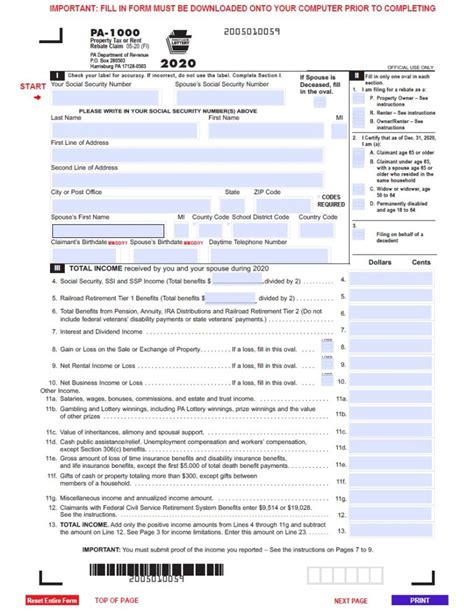

2. Complete the PA Rent Rebate Form

The form itself can be downloaded from the Pennsylvania Department of Revenue’s website or obtained at local offices. On the form, you will need to provide basic personal information, income details, and your rental history.

3. Submit Your Application

Once the form is completed, you can submit it through various methods, including:

- By mail to the address specified on the form.

- In person at your local county agency.

- Some residents may also have the option to apply online through the Department of Revenue’s e-filing system.

4. Await Confirmation

After submitting your application, you will receive a confirmation from the Pennsylvania Department of Revenue. Keep this for your records. Processing may take a few weeks, so be patient.

When to Apply

Applications for the Rent Rebate can be submitted starting July 1 of the year following the rental period. For example, for rents paid in 2022, applications opened on July 1, 2023. It’s crucial to remember that there is no deadline for submission, but early applications can lead to quicker responses.

Amount of Rebate

The amount of your rebate depends on the rent you paid and your income level. The maximum rebate is $650, but for renters in specific circumstances, it can reach up to $975. Understanding this structure can help you project your potential savings accurately.

Common Mistakes to Avoid

To ensure a smooth application process, consider these common pitfalls:

- Incomplete Forms: Ensure all fields are filled out and double-check for any missing information.

- Failure to Include Documentation: Always provide requested supporting documents to avoid unnecessary delays.

- Ignoring Deadlines: Know the submission timelines and get your application in as early as possible.

Using the Rebate Wisely

Once you receive your rebate, it’s essential to use it effectively. Consider allocating your funds toward necessary expenses, savings, or even investing in home improvements that can further reduce your housing costs.

Conclusion

The PA Rent Rebate program serves as a beacon of hope and financial relief for eligible Pennsylvanians struggling with rent obligations. By understanding the eligibility requirements, streamlining the application process, and avoiding common mistakes, you can unlock significant savings. Don’t forgo this opportunity—take charge of your financial well-being today.

Frequently Asked Questions (FAQs)

1. How long does it take to receive my rebate?

The processing time can vary, but it typically takes a few weeks. You will receive a confirmation once your form has been processed.

2. Can I apply for multiple years?

Yes, you can apply for rebates for each year that you qualify, but applications must be submitted each year following the timeline outlined by the Department of Revenue.

3. Is the rent rebate taxable?

No, the rent rebate is not considered taxable income by the state of Pennsylvania.

4. What if I missed the application period?

While there is no strict deadline, it’s recommended to apply as soon as you qualify. You can check with your local county office for assistance if you need to apply for previous years.

5. How can I check the status of my application?

You can contact the Pennsylvania Department of Revenue or check their website for updates about your application status.

This HTML format is suitable for WordPress, and can be copied directly into the HTML editor of a WordPress post or page to create a comprehensive guide about the PA Rent Rebate Form.

Download Pa Rent Rebate Form