Introduction

As the world increasingly shifts towards sustainable energy sources, electric vehicles (EVs) have become a popular choice for environmentally conscious consumers. In 2025, an array of electric car rebates and incentives will be available for those looking to purchase or lease an electric vehicle. This article will guide you through the essential aspects of these rebates, ensuring you are well-informed before making your purchase.

Understanding Electric Car Rebates

Electric car rebates are financial incentives offered by governments or other organizations to encourage consumers to buy electric vehicles. These rebates can significantly reduce the upfront cost of purchasing an EV, making it a more accessible option for many. Rebates can come in various forms, including direct rebates, tax credits, and state-level incentives.

Types of Electric Car Rebates Available in 2025

Federal Rebates

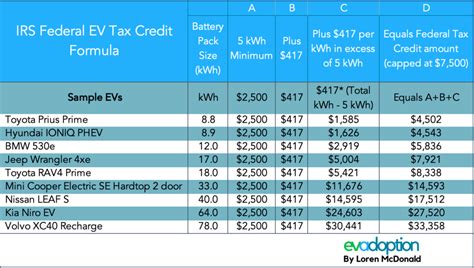

The federal government plays a crucial role in promoting electric vehicle adoption through various rebate programs. As of 2025, buyers of new electric vehicles may be eligible for a federal tax credit of up to $7,500, depending on the vehicle’s battery capacity and manufacturer’s sales cap. This credit can substantially offset the initial cost of your electric vehicle.

State and Local Rebates

In addition to federal rebates, many states and local governments offer their own incentives. For example, states like California, New York, and Texas have lucrative programs that can provide rebates, tax credits, and even exemptions from registration fees. It’s essential to check your specific state’s incentives, as they vary widely.

Utility Company Rebates

Many utility companies also contribute to the push for electric vehicle adoption by offering rebates for EV purchase and installation of home charging stations. Some utilities have programs that offer rebates ranging from a few hundred to several thousand dollars, depending on the capacity of the charging station and the specifics of the EV purchase.

Eligibility Criteria for Rebates

Not everyone may qualify for the available electric car rebates. Eligibility criteria often include:

- Income Level: Some programs have income thresholds, meaning that higher-income individuals might not be eligible.

- Vehicle Type: Rebates are typically only applicable to new electric vehicles. Financing options or leasing agreements may also affect eligibility.

- Manufacturer Limits: In some cases, manufacturers may hit a cap on the number of vehicles eligible for federal tax credits, limiting some consumers’ opportunities.

- Home Charging Station Installation: Certain rebates may require you to install a home charging station, which could involve additional costs and requirements.

Finding the Right Electric Vehicle

When considering which electric vehicle to purchase, there are several factors to take into account:

- Range: The driving range of the EV on a single charge is a crucial factor. Depending on your daily commute and driving habits, you will want a vehicle that meets your range needs.

- Charging Options: Look into the availability of public charging stations in your area. Some EVs offer faster charging solutions than others.

- Cost vs. Features: Balance the upfront costs with features such as cargo space, technology, and safety ratings to find the best fit for you.

How to Claim Your Electric Car Rebate

Claiming your electric vehicle rebate can vary based on the type of rebate. Here’s a general outline of the process:

- Research: Investigate available rebates in your state and ensure you meet eligibility criteria.

- Purchase: Buy or lease your electric vehicle, keeping all receipts and documents related to the purchase.

- Complete the Application: Fill out the rebate claim form, ensuring all information is accurate.

- Submit Your Application: Follow the submission guidelines, whether online or via mail.

- Await Approval: Depending on the program, it may take weeks or months to receive your rebate.

Conclusion

With the growing trend of electric vehicles, 2025 presents a unique opportunity for consumers to take advantage of significant rebates and incentives. Understanding the different types of rebates, eligibility criteria, and the overall process to claim them can make your transition to an electric vehicle smoother and more economical. Staying informed will not just save you money but also contribute to a sustainable future. Always consult specific rebate guidelines and speak with dealership representatives to ensure you maximize your benefits.

FAQs

1. What is the maximum federal rebate for electric cars in 2025?

The maximum federal tax credit for electric vehicles remains up to $7,500, based on battery capacity and manufacturer sales limits.

2. Are there specific electric vehicles that qualify for the rebates?

Yes, eligibility criteria often include specific vehicle types, ranging from compact cars to SUVs. Refer to the federal and state websites for detailed lists of qualifying models.

3. How do I know if I’m eligible for state rebates?

You can check with your state’s motor vehicle agency or public utility commission to find eligibility criteria and application procedures for state-level rebates.

4. Can I combine federal and state rebates?

Yes, in most cases you can combine federal and state rebates, which can substantially lower your overall EV purchase cost. However, it’s essential to check specific guidelines to avoid disqualifications.

5. What should I do if my rebate application is denied?

If your application is denied, you usually have the option to appeal the decision. Contact the rebate program directly to understand the specific reasons for denial and potential remedies.

Download Electric Car Rebates 2025