The transition to electric vehicles (EVs) has gained immense momentum in recent years, with consumers increasingly becoming aware of the environmental benefits as well as the potential financial savings associated with this automotive revolution. One significant incentive for potential EV buyers is the range of electric car rebates available, which can significantly reduce the overall cost of purchasing an electric vehicle. This guide will highlight the various types of electric car rebates, how to qualify for them, and provide tips for maximizing savings.

Understanding Electric Car Rebates

Electric car rebates can come in various forms, from federal and state tax credits to cash incentives offered by local governments and utility companies. These rebates are intended to encourage the adoption of electric vehicles, thereby reducing greenhouse gas emissions and reliance on fossil fuels.

Federal Tax Credit

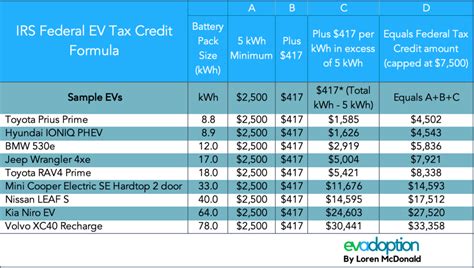

The federal government offers a tax credit for electric vehicles through the IRS Section 30D program. This credit can be as high as $7,500, depending on the vehicle’s battery capacity. However, the amount of the credit is gradually phased out once a manufacturer sells 200,000 qualified EVs. Notable manufacturers like Tesla and General Motors have seen their credits reduced due to this cap, making it essential for buyers to check the current eligibility status of their chosen vehicle.

State Incentives

Many states offer additional rebates or incentives for electric car buyers, which can vary widely. For example:

- California: Offers a Clean Vehicle Rebate Project (CVRP) up to $7,000 for eligible EVs.

- New York: Provides a rebate for electric car purchases, offering up to $2,000 for eligible purchases.

- Colorado: Offers an income tax credit of up to $5,000 for electric vehicle purchases.

- Texas: Has a rebate program that provides up to $2,500 for qualifying vehicles.

Check with your state’s Department of Motor Vehicles (DMV) or the local energy office for specific programs available.

Local Incentives

In addition to state and federal rebates, many local governments and municipalities offer their own incentives. These can include cash rebates, reduced registration fees, and exemptions from certain taxes. Furthermore, some cities provide free charging stations or discounted rates for electric vehicle owners. Researching local initiatives can uncover additional savings often overlooked by buyers.

Utility Company Incentives

Utility companies are also jumping on the bandwagon, offering rebates for EV owners as a way to encourage off-peak charging and reduce the burden on the grid during peak usage times. These incentives can include:

- Reduced electricity rates for EV charging during designated hours.

- Cash rebates for installing home charging equipment.

- Free or discounted charging at public charging stations.

It’s advantageous for EV buyers to check with their local utility company to discover available credits and programs.

Maximizing Electric Car Rebates

To take full advantage of electric car rebates, consider the following tips:

- Research Before Buying: Before purchasing an electric vehicle, explore all available federal, state, and local incentives. Knowing what rebates are available can help you negotiate better pricing with dealers.

- Purchase Eligible Vehicles: Make sure the vehicle you intend to buy qualifies for all available incentives. Not all electric vehicles will be eligible for the federal tax credit or state rebates.

- Act Quickly: Many rebate programs have limited funding available. Once the allocated funds for a program are exhausted, the rebates may no longer be available.

- Keep Documentation: Maintain all receipts, documentation, and any forms required for rebates to ensure a smooth rebate application process.

- Consult with a Tax Professional: When claiming federal and state tax credits, it’s wise to engage with a tax professional to ensure that you maximize your savings and remain compliant with all regulations.

Conclusion

Making the leap to an electric vehicle represents a significant commitment to environmental stewardship and personal savings. Understanding the various forms of electric car rebates can effectively alleviate some of the upfront costs associated with EV ownership. By researching and utilizing available federal, state, local, and utility incentives, buyers can drive home in their new vehicle while saving money and contributing to a more sustainable future.

FAQs

1. How do I know if my electric vehicle qualifies for the federal tax credit?

You can determine if your EV qualifies by visiting the IRS website or checking with the vehicle manufacturer for its credit eligibility status.

2. Are electric car rebates available for used electric vehicles?

Many federal and state rebate programs are primarily aimed at new electric vehicle purchases. However, some state programs may offer incentives for used EVs, so it’s essential to check with local regulations.

3. Can I combine federal tax credits with state and local rebates?

Yes, in most cases, you can combine different types of rebates and incentives, but it’s important to confirm with tax and rebate regulations to ensure compliance.

4. When will I receive my rebate after applying?

The time it takes to receive rebates varies. Federal refunds are typically applied when you file your tax return, while state and local rebates may take a few weeks to process after application submission.

5. Where can I find more information on electric vehicle rebates specific to my location?

Local government websites, the Department of Energy, and the Electric Vehicle Association are excellent starting points to find specific information related to your location.

This code snippet is an article formatted in HTML suitable for WordPress, with each section clearly delineated, providing a comprehensive guide to electric car rebates.

Download Rebates For Electric Cars