Driving Change: A Comprehensive Guide to California’s Electric Vehicle Rebates

As California leads the nation in electric vehicle (EV) adoption, the state has created numerous incentives to encourage its residents to switch from traditional gas-powered vehicles to electric alternatives. With a goal of reducing greenhouse gas emissions and improving air quality, these initiatives include various rebate programs funded by both the state and federal governments. This guide serves as a comprehensive overview of California’s electric vehicle rebates, which can significantly lower the cost of purchasing an EV.

An Overview of Electric Vehicle Rebates

California offers several rebate programs that provide financial assistance for the purchase or lease of electric vehicles. Among these, the most prominent is the California Clean Vehicle Rebate Project (CVRP), which was established by the California Air Resources Board (CARB) to promote the adoption of electric vehicles and plug-in hybrids. In addition to state-level rebates, many utility companies and local governments also offer additional incentives that can further decrease the total cost of owning an EV.

The California Clean Vehicle Rebate Project (CVRP)

The CVRP offers rebates to individuals, businesses, and government agencies for the purchase or lease of new qualified zero-emission and plug-in hybrid vehicles. The rebate amounts vary depending on the vehicle type and the buyer’s income.

- For Battery Electric Vehicles (BEVs): Rebates can be as high as $2,000.

- For Plug-in Hybrid Electric Vehicles (PHEVs): Rebates can be up to $1,000.

- Low-income applicants may receive an additional $1,000 on top of the standard rebate amount.

Eligibility Criteria

To be eligible for a rebate through the CVRP, applicants must meet certain criteria:

- The vehicle must be new and meet California emissions standards.

- Applications must be submitted within 18 months of the vehicle purchase or lease.

- Applicants must have a valid California driver’s license and residency.

- Based on income, applicants may qualify for the low-income bonus.

Application Process

Applying for a rebate through the CVRP is a straightforward process:

- Purchase or lease an eligible vehicle from a dealership that is a participating retailer.

- Gather necessary documents, including proof of purchase or lease, income documentation (if applicable), and California residency proof.

- Visit the CVRP website to complete the online application form.

- Submit the application along with the required documentation.

Once the application is processed, applicants will receive notification about their rebate status, typically within 90 days.

Local Utility Incentives

In addition to the state-level rebates, many utility companies in California offer their own incentives for EV purchasers. These can include rebates on home charging equipment, discounts on electricity rates during off-peak hours, and cash incentives for purchasing an EV. Programs can vary significantly depending on the utility provider, so it is advisable for EV buyers to check with their local utility for any available incentives.

Federal Electric Vehicle Tax Credit

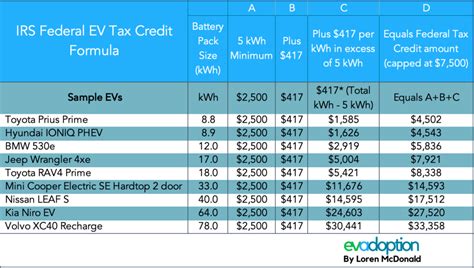

In addition to state and local incentives, some EV buyers may also be eligible for a federal electric vehicle tax credit. As of now, qualified electric vehicles can receive a credit of up to $7,500, depending on factors such as battery capacity and vehicle type. It is essential for potential buyers to review the current federal guidelines as eligibility criteria and credit amounts can change with legislation.

Environmental Benefits Beyond Rebates

Switching to electric vehicles offers numerous environmental benefits beyond potential rebates. EVs have lower lifetime emissions compared to their internal combustion engine counterparts, contributing significantly to California’s goals for reducing air pollution and combating climate change. Additionally, many EVs can be powered by renewable energy sources, further decreasing their carbon footprint.

Conclusion

California’s electric vehicle rebate programs are crucial in encouraging residents to transition to sustainable transportation. With significant financial incentives available through programs such as the CVRP, local utility incentives, and federal tax credits, buyers should take advantage of these opportunities. Moreover, understanding the environmental benefits and contributions to air quality initiatives adds another layer of motivation for switching to electric vehicles. As California continues to pioneer advancements in green technology and sustainability, its commitment to supporting electric vehicle adoption enables residents to join the change for a cleaner future.

FAQs

What is the California Clean Vehicle Rebate Project (CVRP)?

The CVRP is a program that offers rebates for purchasing or leasing qualified electric vehicles in California to help reduce greenhouse gas emissions.

What types of vehicles are eligible for rebates in California?

Eligible vehicles include battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) that meet California’s emissions standards.

How much can I receive from the rebate?

The maximum rebate for BEVs is $2,000, while PHEVs can receive up to $1,000. Additional bonuses are available for low-income applicants.

What is the deadline for applying for the CVRP rebate?

You can apply for the CVRP rebate within 18 months of the vehicle purchase or lease date.

Are there any additional incentives for electric vehicles available in California?

Yes, many local utility firms offer their own rebates and incentives on top of state and federal programs. It’s important to check with local providers.

This HTML format is designed for quick implementation into a WordPress article editor, maintaining the proper structure for headings, paragraphs, lists, and sections.

Download California Rebates For Electric Vehicles