Driving Green: The Benefits of Tax Rebates for Hybrid Car Owners

In recent years, the automotive industry has witnessed a remarkable transformation, shifting from traditional combustion engines to hybrid and fully electric vehicles. This transition is not just a trend but a pivotal move towards sustainability and reducing our carbon footprints. One of the significant incentives encouraging this shift is tax rebates for hybrid car owners. In this article, we will explore the various benefits these tax rebates provide, not only for the environment but also for drivers’ wallets.

Understanding Hybrid Cars

A hybrid car combines a conventional internal combustion engine with an electric propulsion system. This design allows for improved fuel efficiency and reduced emissions compared to traditional vehicles. With increasing concerns about air quality and climate change, hybrid cars have become a popular choice for eco-conscious consumers.

The Financial Incentives: Tax Rebates

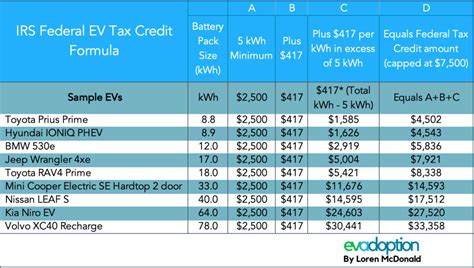

Tax rebates for hybrid car owners are financial incentives offered by governments to encourage the purchase of environmentally friendly vehicles. These rebates can vary significantly depending on the location and the specific vehicle purchased. In many countries, these rebates can range from a few hundred to several thousand dollars, making the initial investment in a hybrid vehicle much more appealing.

Benefits of Tax Rebates for Hybrid Car Owners

1. Reduced Purchase Price

The most immediate benefit of a tax rebate is the reduction in the purchase price of a hybrid vehicle. By applying for a rebate, buyers can significantly lower their upfront costs, making hybrid cars more accessible to a broader range of consumers. This financial break can be a deciding factor for many, allowing them to invest in a more environmentally friendly option without straining their finances.

2. Improved Fuel Economy

Hybrid vehicles are known for their excellent fuel economy, saving drivers a substantial amount of money at the pump. While tax rebates help reduce the initial cost, the ongoing savings at the fuel station can be equally beneficial. Many hybrid cars achieve miles-per-gallon ratings that far exceed those of their gas-only counterparts, contributing to longer-term savings.

3. Lower Emissions

One of the core reasons for promoting hybrid vehicles is their reduced emissions compared to traditional cars. When more hybrid vehicles are on the road, the overall emissions from transportation decrease. Tax rebates not only promote individual savings but also contribute to a larger societal shift towards greener transportation solutions.

4. Potential for Additional Financial Incentives

In addition to federal tax rebates, many states and local governments offer additional incentives such as rebates, grants, or exemptions from various fees (like registration taxes). Hybrid car owners may find themselves eligible for multiple financial benefits, maximizing their savings in numerous ways.

5. Increased Resale Value

As the demand for eco-friendly vehicles continues to rise, hybrid cars often have a higher resale value than traditional vehicles. This is another consideration for prospective buyers; the initial tax rebate combined with the better resale value can make hybrid cars an excellent long-term investment.

6. Contribution to a Sustainable Future

By choosing a hybrid vehicle, owners are not only making a personal financial decision but are also contributing to a larger environmental cause. The reduction in fossil fuel consumption and greenhouse gas emissions plays a crucial role in combating climate change. Each hybrid vehicle on the road can make a difference, supported effectively by government initiatives like tax rebates.

Conclusion

As we navigate through the challenges of climate change and environmental degradation, hybrid vehicles present a viable solution that benefits both consumers and the planet. Tax rebates for hybrid car owners serve as a compelling incentive for individuals to embrace a greener lifestyle. Not only do these rebates make the purchase of hybrid vehicles more affordable, but they also promote a healthier environment and contribute to sustainable practices. Choosing a hybrid car is not merely a financial decision but a step towards creating a sustainable and green future for generations to come.

FAQs

1. What qualifies for a hybrid vehicle tax rebate?

Typically, a hybrid vehicle must meet specific criteria that demonstrate its environmental benefits, such as emissions ratings and fuel efficiency. Check with local or federal regulations to confirm eligibility.

2. How much can I expect in tax rebates for my hybrid vehicle?

The amount of the tax rebate varies significantly based on location and the make and model of the vehicle. Federal rebates in the United States can go up to $7,500, while additional state-level rebates may also apply.

3. How do I apply for a hybrid vehicle tax rebate?

You can typically apply for a tax rebate when you file your annual tax returns. You may need to complete specific forms and provide proof of the vehicle purchase.

4. Are there any drawbacks to purchasing a hybrid vehicle?

While hybrids offer many benefits, potential drawbacks may include higher maintenance costs in some cases and potentially less powerful engines compared to traditional vehicles. It’s essential to weigh the pros and cons before making a decision.

5. Can I claim a rebate for a used hybrid vehicle?

In many cases, tax rebates apply only to new vehicle purchases. However, some states may offer incentives for used hybrid vehicles as well. It’s best to check with local regulations.

Download Tax Rebate For Hybrid Cars