As the world becomes increasingly aware of the impact of climate change, many individuals are seeking ways to reduce their carbon footprint. One effective approach is to drive a hybrid vehicle. Not only do these vehicles contribute to a greener environment, but they also come with various financial incentives designed to make them more accessible to consumers. One of the most appealing incentives is tax rebates. In this article, we will delve into the realm of hybrid vehicles and the tax rebates available for them, helping you understand how you can benefit from making a green choice.

What is a Hybrid Vehicle?

Before diving into tax rebates, it’s essential to understand what hybrid vehicles are. Hybrid vehicles combine an internal combustion engine with an electric motor. This dual system allows them to use less fuel and produce fewer emissions compared to traditional gasoline-powered vehicles. There are various types of hybrids, including:

- Full Hybrids: These can run on just the electric motor, the gas engine, or a combination of both.

- Plug-in Hybrids: Similar to full hybrids but with a larger battery that can be charged via an electric power source.

- Mild Hybrids: These enhance fuel efficiency but cannot operate solely on electric power.

Understanding Tax Rebates for Hybrid Vehicles

Governments around the world have implemented tax incentives to encourage the adoption of hybrid and electric vehicles. In the United States, these incentives typically come in the form of tax credits or rebates and can significantly reduce the overall cost of purchasing a hybrid vehicle.

What Are Tax Credits?

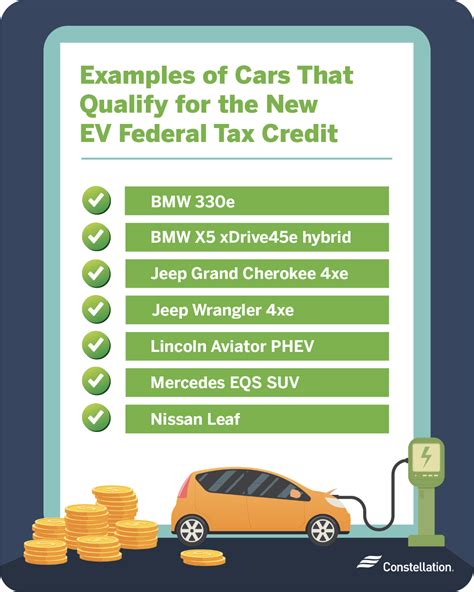

Tax credits directly reduce the amount of tax owed, making them preferable to deductions, which only reduce taxable income. When you purchase a qualifying hybrid vehicle, you may be eligible for a federal tax credit of up to $7,500. The exact amount depends on the make and model of the vehicle, as well as the size of the battery. It’s important to note that the credit phases out once a manufacturer sells 200,000 qualifying electric or hybrid vehicles.

State and Local Incentives

In addition to federal tax credits, many states and local governments offer their incentives for hybrid vehicles. These can include:

- State Tax Credits: Varying amounts depending on the state, often as substantial as federal credits.

- Rebates: Some states offer direct rebates on the purchase price of the vehicle.

- Reduced Registration Fees: Discounts on vehicle registration can lead to savings over time.

- Access to HOV Lanes: Many states allow hybrid drivers to use high-occupancy vehicle lanes, even with a single occupant.

How to Claim the Tax Incentives

Claiming tax credits for your hybrid vehicle typically requires you to complete IRS Form 8834, the Qualified Plug-In Electric Drive Motor Vehicle Credit. Additionally, you will need to provide your vehicle’s VIN (Vehicle Identification Number) and proof of purchase. It’s advisable to consult a tax professional or use tax preparation software to ensure you maximize your benefits.

Factors Affecting Eligibility

Not all hybrid vehicles are eligible for tax credits. To qualify, a vehicle must:

- Be new and purchased, as used vehicles are not eligible.

- Meet specific battery capacity requirements (the larger the battery, the higher the tax credit).

- Be manufactured by a company that hasn’t exceeded the sales cap for qualifying vehicles.

Environmental Impact and Personal Benefits

Making the switch to a hybrid vehicle is not just about financial incentives; it also has profound environmental implications. Hybrid vehicles reduce greenhouse gas emissions and fuel consumption, contributing to a cleaner atmosphere. In addition to environmental benefits, hybrid vehicles typically offer lower operating costs due to improved fuel efficiency and reduced emissions, making them economical in the long run.

Challenges and Considerations

While hybrid vehicles come with numerous benefits, potential buyers should also consider some challenges. The initial purchase price of hybrids can be higher than that of traditional vehicles, even with tax incentives. It’s crucial to conduct a cost-benefit analysis, factoring in the potential savings from fuel efficiency and maintenance costs. Additionally, some consumers may worry about battery longevity and replacement costs, although advancements in technology have significantly improved battery life and performance.

Conclusion

Driving a hybrid vehicle represents a significant step toward sustainable living. With various tax rebates and incentives available, the financial benefits of owning a hybrid are compelling. By understanding these incentives, you can make a more informed decision when purchasing your next vehicle, contributing not only to your financial well-being but also to the health of our planet. As green technology continues to evolve, the expectation for consumers to embrace hybrid vehicles will only grow stronger, making it crucial to stay informed about the latest developments and incentives.

FAQs

1. How much is the federal tax credit for hybrid vehicles?

The federal tax credit can be as much as $7,500, depending on the vehicle’s make, model, and battery capacity.

2. What types of hybrid vehicles are eligible for tax rebates?

Both full hybrids and plug-in hybrids are generally eligible, provided they meet specific criteria set by the IRS.

3. Can I receive a tax rebate for a used hybrid vehicle?

No, tax rebates or credits are typically available only for new vehicles.

4. How do I apply for a tax credit for my hybrid vehicle?

You can claim the credit by filling out IRS Form 8834 when filing your tax return.

5. Are there any state-specific tax credits for hybrid vehicles?

Yes, many states offer their tax credits or rebates; it’s wise to check your state’s specific incentives.

Download Tax Rebates For Hybrid Cars