Introduction

Tax season can often feel overwhelming, with numerous forms, deductions, and requirements to navigate. One crucial aspect that taxpayers must consider is the potential for tax rebates, which can provide significant financial relief. However, understanding your eligibility for a tax rebate and tracking its status can be just as daunting. This guide will walk you through how to check if you’re eligible for a tax rebate and how to track its status, ensuring you’re informed and prepared.

Understanding Tax Rebates

A tax rebate, also known as a tax refund, occurs when a taxpayer has paid more taxes than they owe. This can happen for various reasons, including over-withholding from your paycheck, eligible deductions not claimed, or tax credits applied incorrectly. Tax rebates can provide a much-needed financial boost, especially in challenging times.

Step 1: Determine Your Eligibility

Before diving into how to check your tax rebate status, it’s essential to determine if you’re eligible for a rebate. Here are some factors to consider:

- Income Level: Certain tax rebates are designed for low- to moderate-income households. Check the income thresholds for specific rebates.

- Filing Status: Your filing status (single, married filing jointly, head of household, etc.) can impact your eligibility.

- Tax Deductions and Credits: Familiarize yourself with eligible tax deductions and credits, as these can influence the amount of your potential rebate.

- State Specific Rules: Requirements for state tax rebates may vary. Check your state’s tax website for details.

Step 2: Gather Your Documents

Before checking your rebate status, ensure you have the necessary documents handy. These typically include:

- Your completed tax return.

- Your Social Security number or Individual Taxpayer Identification Number.

- Your filing status (e.g., single, married).

Step 3: Check Your Tax Rebate Status

Once you have determined your eligibility and gathered the necessary documents, you can check your rebate status. Here’s how:

Federal Tax Rebate Status

The Internal Revenue Service (IRS) provides an online tool for checking your federal tax refund status:

- Visit the IRS Refund Status page.

- Enter your Social Security number, filing status, and the exact refund amount.

- Click on “Submit” to view your status.

State Tax Rebate Status

Each state has its process for checking tax rebate status. Generally, the process involves:

- Visiting your state’s department of revenue website.

- Locating the section for checking refund status.

- Entering the required information, which usually includes your Social Security number and the exact refund amount.

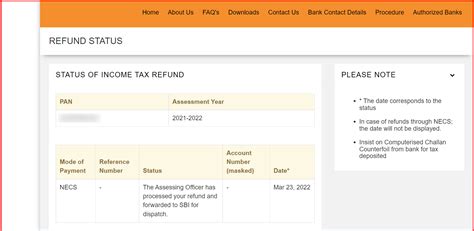

Step 4: Understanding Common Status Messages

After checking your status, you may encounter various messages. Understanding these can alleviate any concerns:

- Processing: The IRS or state is still reviewing your return.

- Approved: Your refund has been approved and will be issued shortly.

- Sent: Your refund has been sent to your bank or mail address.

- Denial: This means your claim was not approved. Ensure to review the reasons and address them accordingly.

Conclusion

Checking your tax rebate status is an essential part of the tax process. By understanding your eligibility and utilizing the appropriate resources, you can ensure that you receive any funds owed to you. Whether federal or state, staying on top of your tax status not only provides peace of mind but also aids in effective financial planning. Always stay informed about tax laws and deadlines to maximize your benefits.

FAQs

1. How long does it take to receive my tax rebate?

Typically, the IRS processes rebates within 21 days if filed electronically. State processing times may vary.

2. What if my tax rebate is lower than expected?

Review your tax return to ensure all credits and deductions were claimed. If discrepancies exist, you may need to correct your return.

3. Can I check my tax rebate status by phone?

Yes, both the IRS and state tax offices have phone lines where you can inquire about your rebate status, though online is often faster.

4. What should I do if my rebate is delayed?

Contact the IRS or your state’s tax office directly for assistance and inquire about the reason for the delay.

5. Do I need to file my taxes to receive a rebate?

Yes, you must file your tax return to be eligible for a tax rebate, even if you anticipate receiving a refund.

Download Check Tax Rebate Status