In recent years, the concept of the Medical Loss Ratio (MLR) has gained prominence in discussions about health insurance and its costs. Introduced as part of the Affordable Care Act (ACA), the MLR aims to ensure that a significant portion of health insurance premiums is directed toward patient care rather than administrative costs or profits. This article will delve into what the Medical Loss Ratio means, how it impacts your health insurance premiums, the potential rebates you could receive, and more.

What is Medical Loss Ratio?

The Medical Loss Ratio is a measure used to determine the percentage of health insurance premiums that an insurer spends on medical care and health services for enrollees. Under the ACA, insurance companies are required to meet specific MLR standards. For large group plans, insurers must spend at least 85% of premium dollars on medical care and health services, while individual and small group plans are required to spend at least 80%.

How Medical Loss Ratio Affects Premiums

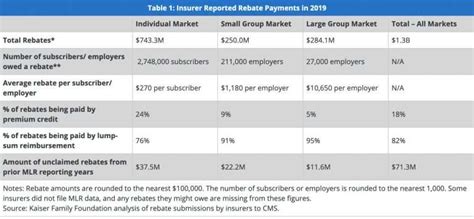

Health insurance companies that do not meet the required MLR threshold must provide rebates to policyholders. These rebates come as a result of excess premium spending that does not go toward patient care. Essentially, the MLR incentivizes insurance providers to minimize administrative costs and maximize the quality of care provided to enrollees.

Understanding how your insurer allocates your premium dollars can shed light on whether you might receive a rebate. If your insurer is spending a lower percentage on actual patient care and more on administrative expenses, policyholders may be entitled to a payment at the end of the year. This means that MLR not only serves as a consumer protection measure but also encourages health insurance companies to operate efficiently in their service delivery.

Understanding MLR Rebates

When an insurance company fails to meet the MLR requirements, they are required to issue rebates to their policyholders. This can be a significant financial relief, especially for those who may find health insurance premiums burdensome. The rebates can come in various forms:

- Checks mailed directly to policyholders.

- Credit applied to premium payments for the following year.

- Reduction in future premiums.

Rebates are usually calculated in the first quarter of the year for the previous year’s spending and are often distributed by August 1. This timeline allows consumers to know how much of their premium was efficiently utilized, adding to transparency regarding fluctuating premium costs.

Potential Impacts on Consumers

The MLR provisions serve multiple purposes. First, they encourage health insurance companies to be more accountable and transparent about their spending. It pushes insurers to prioritize health care services, which can lead to better patient outcomes. Second, MLR contributes significantly to controlling health care costs by setting standards for how premium dollars are spent, giving consumers both an incentive to shop around and peace of mind about their insurance investments.

Challenges with MLR

Despite the benefits of the MLR regulation, it faces some challenges. A primary concern is that insurance companies may unintentionally manipulate how they report medical expenditures to meet MLR requirements without actually improving patient care. This could lead to ‘gaming the system,’ where insurers might keep their administrative costs low without truly investing in health services that benefit their members. Moreover, some argue that insurers may respond to MLR requirements by raising premiums to meet fixed administrative costs.

Conclusion

The Medical Loss Ratio is a pivotal component of modern health insurance regulations. By mandating that insurers allocate a significant portion of premiums toward medical care, the MLR promotes patient care, potentially leading to lower administrative spending and higher value for policyholders. While the MLR is not without its challenges, it fundamentally aims to create a more transparent, competitive, and consumer-friendly health insurance market.

FAQs

What is the Medical Loss Ratio (MLR)?

The Medical Loss Ratio is a requirement for health insurance companies to spend a minimum percentage of premiums on medical care and health services, instead of administrative costs or profits. For individual and small group plans, the MLR requirement is 80%, while for large group plans, it is 85%.

How do I find out if my insurer owes me a rebate?

Insurers typically contact policyholders directly if rebates are issued. You can also check the insurer’s website or review your annual premium statement, which may include information on MLR performance and potential rebates.

What can I do with the rebate I receive?

You can use the rebate as you see fit. Options include depositing it into your bank account, using it toward future premiums, or saving for medical expenses. Consider discussing with a financial advisor if you’re unsure how to best utilize the funds.

Will there be rebates every year?

Not necessarily. Rebates are only issued when an insurer fails to meet the required MLR percentage. If the insurer maintains compliance, you may not receive a rebate in that year.

How does the MLR benefit consumers?

The MLR benefits consumers by ensuring that a significant portion of their premiums goes toward actual medical care rather than administrative costs. This leads to better health services and can potentially lower overall costs in the long run.

This article includes detailed information about the Medical Loss Ratio and is formatted in correct HTML, suitable for use in WordPress.

Download Medical Loss Ratio Rebate