Property taxes can take a significant bite out of your household budget, especially for residents of Minnesota, where property taxes tend to be higher than the national average. Fortunately, Minnesota offers a Property Tax Rebate Program aimed at alleviating some of this financial burden. In this comprehensive guide, we will explore the ins and outs of the program, how to qualify, the application process, and valuable tips to maximize your savings.

Understanding the Property Tax Rebate Program

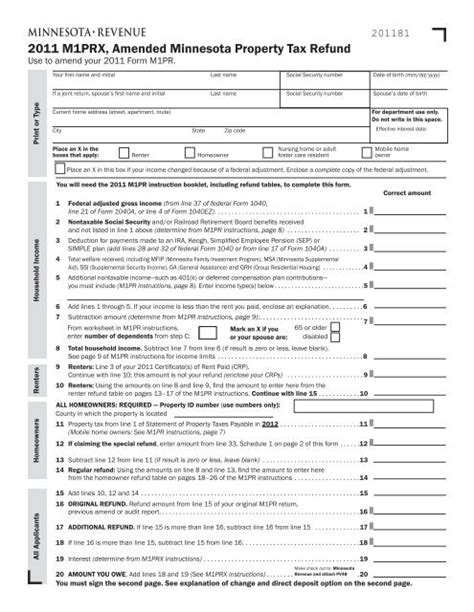

The Minnesota Property Tax Rebate Program provides direct financial assistance to homeowners and renters suffering from high property taxes. This program is designed to help low- to middle-income families offset the cost of property taxes, making homeownership more affordable. The rebate amount is determined by a variety of factors, including your income, the amount of property taxes paid, and the value of your property.

Who Qualifies for the Rebate?

To qualify for the Minnesota Property Tax Rebate Program, applicants must meet specific eligibility criteria:

- Residency: You must be a resident of Minnesota.

- Income Level: The program is designed for low- to moderate-income households. For 2022, applicants must have a household income of $116,180 or less.

- Property Taxes Paid: The property must be your primary residence, and you must have paid property taxes in the year prior to applying.

- Age: While not explicitly required, senior citizens and individuals with disabilities may find more benefits available to them.

How is the Rebate Calculated?

The amount of the rebate is calculated based on a formula that considers two primary factors: your income and the amount of property taxes you paid. Generally, the more you pay in property taxes and the less income you have, the larger your rebate will be.

The program provides a sliding scale for rebate amounts. For instance, if your household income is at the lower end of the income scale, you stand to receive a more substantial rebate compared to those with higher income levels. Review your local property tax statements to assess your eligibility and potential rebate amount.

Application Process

The application process for the Minnesota Property Tax Rebate Program is straightforward and can be completed online or via mail. Here are the steps to follow:

- Gather Required Documents: Collect documents related to your income, property taxes paid, and residency.

- Complete the Application Form: The application form (Form PR-1) can be found on the Minnesota Department of Revenue website.

- Submit Your Application: You can submit your application online or mail it based on your preference. Make sure to file it by the deadline, usually April 15 of the following year.

Maximizing Your Savings

If you want to maximize your rebate, here are some tips:

- Keep Good Records: Ensure you retain all documentation related to property taxes and income. Accurate records will simplify the application process.

- Stay Informed: Tax laws and rebate amounts can change; stay updated on any shifts that could impact your eligibility or rebate amount.

- Consult with a Financial Advisor: If you are unsure about your eligibility or how to apply, consider speaking with a financial advisor knowledgeable about Minnesota’s tax laws.

Common Misconceptions

Several misconceptions can prevent individuals from applying for the Property Tax Rebate Program. One common myth is that only homeowners are eligible. In fact, renters may also qualify for rebates based on the property taxes paid by their landlords.

Another misconception is that the application process is extremely complicated. While it does require documentation, many residents find it manageable with proper preparation.

Conclusion

The Minnesota Property Tax Rebate Program offers much-needed relief for homeowners and renters facing steep property tax bills. By understanding the eligibility criteria and application process, residents can unlock significant savings that can ease their financial burden. Take the time to review your situation and consider applying. Every penny counts, and this program may very well lighten the load on your wallet.

Frequently Asked Questions (FAQs)

- 1. How much can I expect to receive from the Property Tax Rebate?

- The amount varies based on your household income and the property taxes you paid. Generally, lower-income households receive a larger rebate.

- 2. Is the application process difficult?

- No, the process is designed to be user-friendly. Gather your documentation, complete the application form, and submit it either online or via mail.

- 3. What is the deadline for applying?

- The deadline for submitting your application is typically April 15 of the year following the tax year for which you are applying.

- 4. Can renters apply for the rebate program?

- Yes, renters can qualify for a rebate based on property taxes paid by their landlords.

- 5. Where can I find more information?

- Visit the Minnesota Department of Revenue website for detailed information and resources related to the Property Tax Rebate Program.

This HTML format provides a structured article on Minnesota’s Property Tax Rebate Program, including sections for content, conclusion, and FAQs as requested.

Download Property Tax Rebate Minnesota