Unlocking Savings: How to Maximize Your Electric Car Rebate

With the increasing push for sustainable transportation solutions, electric vehicles (EVs) have gained significant attention. Not only do they contribute to reducing greenhouse gas emissions, but they also come with financial incentives that can make transitioning to an electric car more feasible. Electric car rebates are designed to help offset the initial cost of these vehicles. However, many consumers are unaware of how to maximize these rebates effectively. In this article, we will explore various strategies to ensure that you unlock the full potential of your electric car rebate.

Understanding Electric Car Rebates

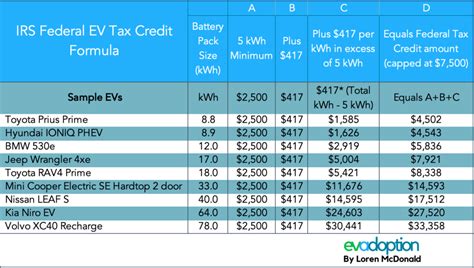

Electric car rebates typically come in two forms: federal rebates and state incentives. The federal government offers a tax credit that can amount to $7,500 for qualifying electric vehicles. On the state level, the incentives can vary greatly, ranging from tax credits and rebates to grants and exemptions from certain fees and taxes.

1. Research Available Rebates

The first step in maximizing your rebate is extensive research. Check both federal and state resources to understand the specific incentives available for your area. The Energy Star website, along with state energy offices, often provides a comprehensive list of available rebates.

2. Verify Vehicle Eligibility

Not all electric vehicles qualify for rebates. The eligibility criteria can include factors such as the type of vehicle, manufacturer sales limits, and battery capacity. Make sure the car you choose meets all the necessary criteria to receive the rebate. Always refer to the Fuel Economy website for updated listings of eligible vehicles.

3. Consider Timing and Purchase Options

Timing your purchase can significantly affect the rebates you receive. Many states offer rebates on a first-come, first-served basis, meaning that waiting too long could mean missing out on funds. Additionally, consider whether buying or leasing makes more financial sense for you. Some incentives may apply differently depending on your purchase method.

4. Stack Incentives

Many consumers don’t realize that they can combine different rebates and incentives. In many states, it’s possible to stack federal rebates with state rebates, and even additional local incentives. Check for any utility company incentives that may be available as well. Always be sure to read the fine print and consult with local authorities to ensure compliance.

5. Explore Charging Infrastructure Incentives

Investing in charging stations can also yield significant savings. Some states provide incentives for home charging infrastructure installation, allowing additional rebates in tandem with vehicle purchases. These charging incentives can help offset the cost of purchasing and installing home charging stations, making it an essential consideration for new EV owners.

6. Savvy Negotiation and Dealer Relationships

When purchasing your electric vehicle, negotiate with dealerships. Understanding the rebates available and their terms gives you leverage during discussions. Some dealers may even have exclusive promotions or can assist you in the process of applying for these rebates, helping you maximize your financial benefits.

7. Stay Informed on Changes and Updates

Rebate programs and incentives often change based on government policy, budget allocations, or even public demand. Stay informed about any changes or new programs that may be introduced. Engaging in local EV communities or following relevant social media pages can help keep you up-to-date with the latest news.

8. Keep All Documentation Organized

To successfully claim your rebates, ensure that you maintain all related documentation. This includes your vehicle purchase or lease agreement, any forms for applying for rebates, and receipts for charging infrastructure installations. Having a well-organized file can streamline the process and simplify claiming your savings.

Conclusion

Maximizing your electric car rebate requires a proactive approach and a bit of research. Understanding the various incentives available, ensuring vehicle eligibility, and considering purchase strategies are all vital components of optimizing your savings. By effectively navigating the rebate landscape, you can make electric vehicle ownership not just an environmentally friendly choice, but also a financially smart one.

FAQs

What is the federal electric vehicle tax credit?

The federal electric vehicle tax credit allows buyers to claim up to $7,500 on their tax return for qualifying electric vehicles. The amount depends on the battery capacity and whether the car manufacturer has exceeded a sales threshold.

Are rebates available for used electric vehicles?

Some states offer rebates for used electric vehicles, but this varies greatly. Always check local regulations and incentives to see if a used EV qualifies for any rebates.

Can I receive a rebate if I lease an electric vehicle?

Yes, leasing an electric vehicle can also come with rebate eligibility. However, the amount and type of rebate may vary compared to purchasing. It’s essential to verify the terms during your lease negotiation.

How do I apply for the electric vehicle rebate after purchase?

Applying for a rebate typically involves filling out a specific form provided by your state or the IRS for federal credits. Be sure to check the exact process and deadlines for submission in your area.

What if I don’t have enough tax liability to take full advantage of the tax credit?

If your tax liability is less than the credit amount, you may not be able to utilize the full credit in that tax year. Some states may allow you to roll over the credit to future years, so it’s crucial to check specific state rules.

Download Rebate For Electric Car